This project contributes to understanding and enhancing socioeconomic and environmental benefits of biofuels through modeling the effect of prices and policy incentives on fuel markets for “hard-to-decarbonize” transportation sectors. The main analytical tool used in this project is the BioTrans model, originally developed to assess and quantify the economic and energy security benefits of biofuels for light-duty vehicles and bioproducts. This project restructured and updated the BioTrans model to assess biofuels for the hard-to-decarbonize transportation sectors such as the aviation and shipping.

The BioTrans model is a market equilibrium model assessing the biofuel supply chain for a 30-year horizon with annual periods. It is a national (United States) model and has states as its spatial units. The model maximizes social surplus, which implies minimizing the costs, while meeting transportation fuel demands. While it takes transportation fuel markets into account endogenously, land allocation decisions and non-biofuel uses of biomass are considered exogenously. The model considers potential synergies or competition for the use of biomass among the different transportation segments as well as the competition between new biofuels and incumbent petroleum-based fuels.

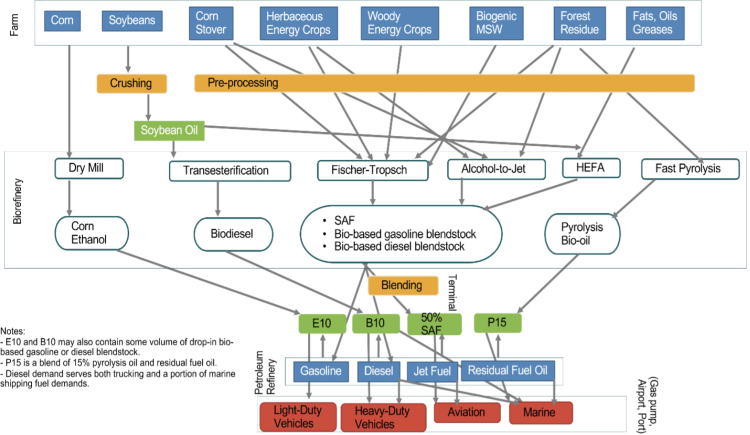

The diagram in Figure 1 summarizes the main components included in BioTrans as of June 2024.

The biomass feedstocks and petroleum products in blue rectangles are those for which the model includes supply curves, and the transportation segments in red boxes are those for which the model includes demand curves. The intermediate activities reflect the steps required to convert biomass into biofuel, and the intermediate products are biofuels required for blending and retail. Each commodity must satisfy a material balance equation so that its sources and sinks match with each other.

The ability to explore the interaction of federal and state-level biofuel policies and their impact on the volume and mix of biofuels produced in the United States is one of the key attributes of the model. As of June 2024, BioTrans contains representations of the following biofuel-related policies and incentives:

Federal

- Renewable Fuel Standard

- Inflation Reduction Act (IRA) tax credits (Section 13201, Section 13202, Section 13203, Section 13704)

State

- California Low Carbon Fuel Standard

- Oregon Clean Fuel Program

- SAF tax credits

- Biodiesel and biomass-based diesel blending mandates

The code for the BioTrans model is available at https://code.ornl.gov/bioenergy/biotrans_model